The OECD points out that public investment and exports will drive economic growth this year. If before it predicted a 1% growth in GDP, it now points to a 2.5% expansion.

Three international institutions have already doubled their growth forecasts for the Portuguese economy this year. This time it was the OECD, which went from a projection of 1% of GDP in November to 2.5% in the latest Economic Outlook, released this Wednesday. It thus joins the European Commission and the IMF, and all three now have more optimistic projections than the Government, which in the Stability Program 2023-2027 included a growth forecast of 1.8% for GDP.

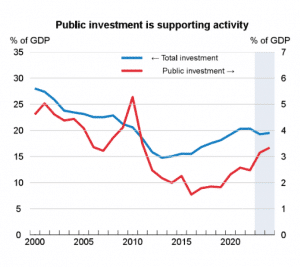

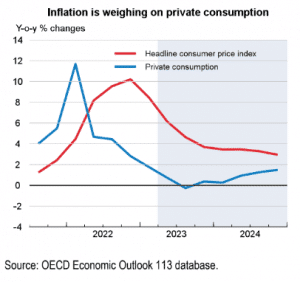

The OECD has thus revised growth upward to 2.5% in 2023, slowing to 1.5% in 2024. Despite inflation weighing on private consumption, “Recovery and Resilience Plan (RRP)spending , fiscal support measures worth about 3.7% of GDP in 2023 ,and increasing activity in trading partners are supporting activity,” the OECD notes in the draft Economic Outlook.

So in addition to exports, the OECD also sees public investment driving economic activity, even though it may also be adding to “inflationary pressures.”

OECD forecasts for inflation are 5.7% in 2023 and 3.3% in 2024, which will lead to a reduction in the purchasing power of economic agents and “weigh on consumption growth. These forecasts are more pessimistic than those of the Government, which in the Stability Program pointed to inflation of 5.1% in 2023 and 2.9% in 2024.

In this field, OECD economists also argue that “temporary support to cushion the inflationary shock should be phased out,” a warning also replicated by other institutions such as the European Central Bank, which has called for more targeted support.

As for the RRP, while they stress the importance of these investments, namely to “strengthen green infrastructure, skills acquisition and healthcare capacity, supporting sustainable growth,” they warn that “it may also slow the fall of inflation.”

As for public debt, the OECD warns that the ratio to GDP “remains high,” noting that ” public debt has fallen below the 2019 level, but remains the third highest in the European Union,” they point out. The OECD thus recommends that “more efficient spending and a strengthened fiscal framework are needed to help address the growing pressures arising from an aging population and strong investment needs.”

The organization predicts that the public debt ratio in the Maastricht view will be 106.2% of GDP in 2023 and 102.9% in 2024, close to the values predicted by the Ministry of Finance (107.5% and 103%, respectively). The deficit should be 0.1% in the next two years. It is more optimistic than Fernando Medina’s team, which still foresees a deficit of 0.4% this year and 0.2% next year.

In this report, the OECD also updates its forecasts for the Eurozone, having already made new projections in March. In view of these figures, growth is revised upwards from 0.8% to 0.9% in 2023. The inflation estimate for the Eurozone in 2023 is revised downwards from 6.2% to 5.8%.